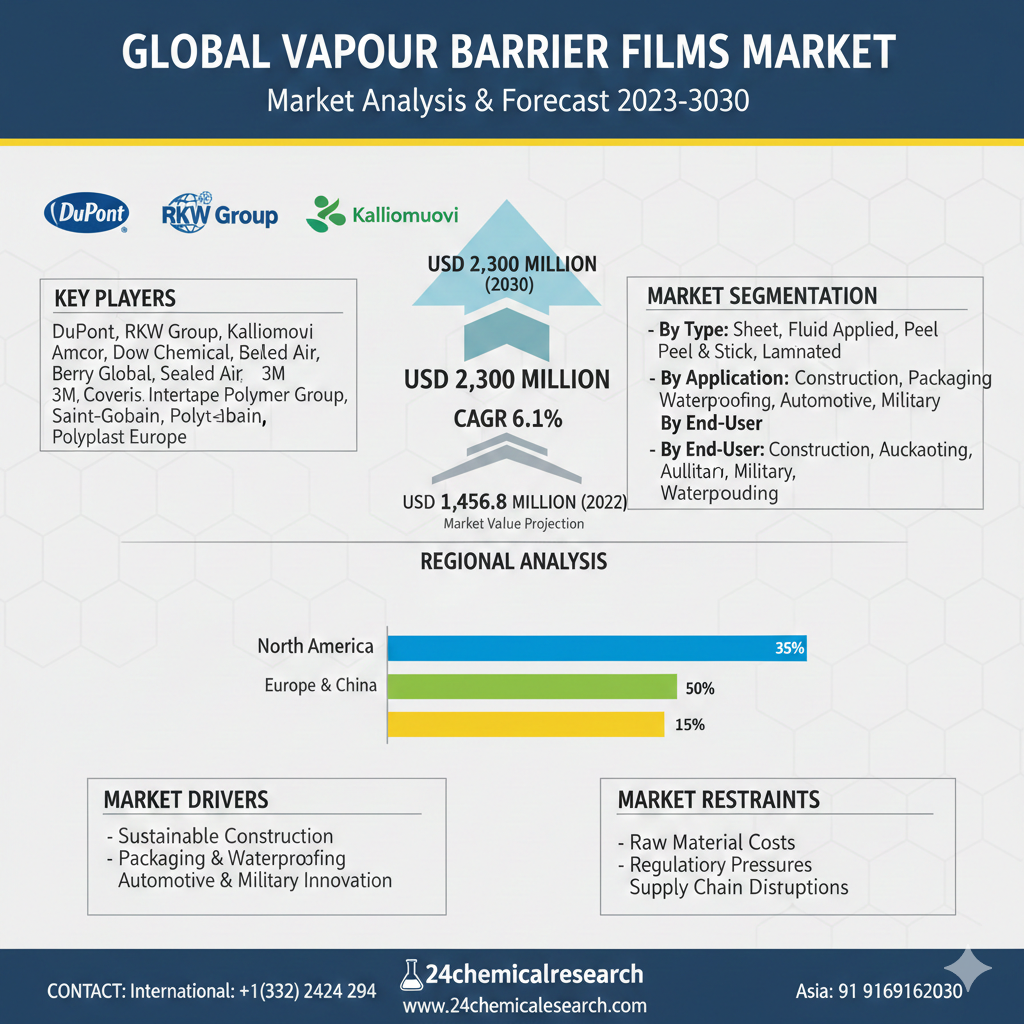

Vapour Barrier Films Market Size USD 1,456.8 Million in 2022 | Forecast to USD 2,300 Million by 2030 at 6.1% CAGR Driven by Sustainable Construction and Packaging Growth

Global Vapour Barrier Films market was valued at USD 1,456.8 million in 2022 and is projected to reach USD 2,300 million by 2030, exhibiting a steady CAGR of 6.1% during the forecast period. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

Vapour barrier films, essential thin layers designed to prevent moisture diffusion in building envelopes and various industrial applications, have evolved from basic protective materials into sophisticated solutions driving modern construction and packaging standards. These films, typically made from polyethylene, polyamide, or metallized polymers, offer low water vapor transmission rates, ensuring durability against humidity, corrosion, and structural degradation. What sets them apart is their ability to balance airtightness with breathability when needed, allowing for energy-efficient buildings that comply with stringent environmental regulations. As global urbanization accelerates, vapour barrier films are increasingly integrated into roofing, walls, flooring, and even flexible packaging, providing reliable protection in diverse climates and uses.

Get Full Report Here: https://www.24chemicalresearch.com/reports/233910/global-vapour-barrier-films-forecast-market-2023-2032-601

Market Dynamics:

The market's trajectory is shaped by a complex interplay of powerful growth drivers, significant restraints that are being actively addressed, and vast, untapped opportunities.

Powerful Market Drivers Propelling Expansion

- Surge in Sustainable Construction Practices: The integration of vapour barrier films into green building designs represents the single largest growth vector. With the global construction industry valued at over $10 trillion and increasingly focused on energy efficiency, these films play a crucial role in reducing moisture-related energy losses by up to 20% in insulated structures. They enable compliance with standards like LEED and BREEAM, where impermeable barriers prevent condensation in walls and roofs. In residential and commercial buildings, vapour barriers are essential for maintaining indoor air quality and preventing mold, driving adoption as builders seek materials that support net-zero goals. This shift is particularly evident in retrofitting projects, where older structures are upgraded for better thermal performance.

- Advancements in Packaging and Waterproofing Solutions: The packaging sector is undergoing transformation, fueled by the need for extended shelf life and protection against environmental factors. Vapour barrier films with high puncture resistance and sealability are ideal for food, pharmaceuticals, and electronics packaging, where moisture control directly impacts product integrity. For instance, in waterproofing applications for bridges and tunnels, these films have shown to extend service life by 15-25 years compared to traditional coatings. As e-commerce booms, with global sales exceeding $5 trillion, demand for lightweight, recyclable vapour barriers in transit packaging surges, offering a cost-effective way to shield goods from humidity during shipping.

- Innovation in Automotive and Military Applications: The automotive industry is being reshaped by vapour barrier films in underbody coatings and battery enclosures for electric vehicles. When applied in thin layers, they enhance corrosion resistance by 30-40%, crucial as EV production ramps up toward 30 million units annually by 2030. These films also contribute to weight reduction, improving fuel efficiency in conventional vehicles. In military uses, such as tent fabrics and vehicle wraps, vapour barriers provide tactical advantages by blocking moisture ingress in harsh environments, supporting operations in diverse terrains. This demand from defense sectors, often backed by government contracts, underscores the films' versatility beyond civilian markets.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/233910/global-vapour-barrier-films-forecast-market-2023-2032-601

Significant Market Restraints Challenging Adoption

Despite its promise, the market faces hurdles that must be overcome to achieve universal adoption.

- Fluctuating Raw Material Costs and Supply Chain Disruptions: The production of high-quality vapour barrier films relies on petrochemical derivatives like polyethylene resins, whose prices have seen volatility of 10-20% in recent years due to oil market swings. Specialized extrusion and lamination processes require precise temperature controls, adding to operational expenses that can be 15-25% higher than standard films. Moreover, achieving uniform thickness and permeability across large rolls remains tricky, with defect rates affecting 10-15% of output in some facilities, which deters smaller manufacturers and raises costs for end-users in price-sensitive sectors like basic construction.

- Regulatory and Environmental Compliance Pressures: In regions with strict building codes, such as the EU's Energy Performance of Buildings Directive, vapour barriers must meet rigorous testing for fire resistance and VOC emissions, with approval processes spanning 12-24 months. The push toward bio-based alternatives adds complexity, as traditional plastic films face scrutiny under plastic waste regulations like the Single-Use Plastics Directive. These factors create uncertainty, potentially delaying projects and increasing compliance costs by 20-30%, which can slow market penetration in eco-conscious markets.

Critical Market Challenges Requiring Innovation

The transition from traditional to advanced vapour barrier solutions presents its own set of challenges. Scaling production to meet rising demand, often exceeding 1 million square meters per month, is tough, with current extrusion lines achieving only 70-80% efficiency due to material inconsistencies. Furthermore, ensuring adhesion and durability in fluid-applied variants is problematic, leading to delamination issues in 20-30% of installations under extreme weather. These technical obstacles demand substantial R&D spending, typically 10-15% of annual budgets for leading firms, erecting barriers for new entrants and requiring breakthroughs in polymer chemistry.

Additionally, the market grapples with a fragmented raw material ecosystem. Price swings in ethylene feedstock (8-15% yearly) and the logistical hurdles of sourcing recycled content, which can add 5-10% to transportation costs compared to virgin materials, breed uncertainty for large-scale buyers. While recycling initiatives grow, the lack of standardized testing for post-consumer films hampers circular economy progress, forcing companies to navigate a patchwork of supplier networks.

Vast Market Opportunities on the Horizon

- Expansion in Green Building and Infrastructure Projects: Vapour barrier films are set to revolutionize sustainable infrastructure. Advanced laminated variants offer vapor permeability rates adjustable for humid climates, outperforming conventional barriers by 25-35% in moisture management while integrating with smart sensors for real-time monitoring. As global infrastructure spending hits $9 trillion by 2025, films tailored for high-rise and modular construction could capture a $1 billion segment, with pilot projects in Asia demonstrating 30% reductions in building maintenance costs through superior waterproofing.

- Enhancements in Flexible Packaging and E-Commerce: Innovative peel-and-stick films are gaining traction in protective packaging. They provide self-sealing properties that extend product freshness by 40-50% in perishables, targeting the $800 billion flexible packaging market. Recent advances in metallized films for electronics have shown electromagnetic shielding alongside vapor control, reducing spoilage in transit. As online retail grows, these solutions promise to cut waste and logistics expenses, opening doors to customized barriers for sensitive goods like medical supplies.

- Collaborative Developments in Specialized Sectors: The market sees rising partnerships, with over 40 alliances in the past two years between film producers and industry leaders to tailor solutions for automotive and military needs. These collaborations shorten development cycles by 25-35%, merging expertise in nanomaterials for ultra-thin barriers that withstand extreme temperatures. Such ties are vital for crossing commercialization gaps, sharing risks in R&D, and accelerating adoption in niche areas like aerospace composites.

In-Depth Segment Analysis: Where is the Growth Concentrated?

By Type:

The market is segmented into Sheet Films, Fluid Applied Films, Peel and Stick Films, and Laminated Vapor Barrier Films. Sheet Films currently leads the market, favored for their simplicity, cost-effectiveness, and ease of installation in large-scale construction projects, including roofing and wall linings. Fluid applied options are gaining ground for irregular surfaces, while peel and stick variants excel in retrofits. Laminated films serve high-performance needs where multi-layer protection is essential.

By Application:

Application segments include Construction, Materials Packaging, Waterproofing, Automotive, and Military. The Construction segment currently dominates, driven by booming urbanization and energy-efficient building demands for moisture control in insulation systems. However, the Materials Packaging and Waterproofing segments are expected to exhibit the highest growth rates in the coming years, fueled by e-commerce and infrastructure resilience needs.

By End-User Industry:

The end-user landscape includes Construction, Packaging, Automotive, Military, and Waterproofing. The Construction industry accounts for the major share, leveraging vapour barrier properties for durable envelopes in residential and commercial builds. The Automotive and Military sectors are rapidly emerging as key growth end-users, reflecting trends in EV protection and tactical gear enhancements.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/233910/global-vapour-barrier-films-forecast-market-2023-2032-601

Competitive Landscape:

The global Vapour Barrier Films market is semi-consolidated and characterized by intense competition and rapid innovation. The top three companies—DuPont (U.S.), RKW Group (Germany), and Kalliomuovi (Finland)—collectively command approximately 45% of the market share as of 2022. Their dominance is underpinned by extensive IP portfolios, advanced production capabilities, and established global distribution networks.

List of Key Vapour Barrier Films Companies Profiled:

- DuPont (U.S.)

- RKW Group (Germany)

- Kalliomuovi (Finland)

- Amcor (Australia)

- Dow Chemical (U.S.)

- Berry Global (U.S.)

- Sealed Air Corporation (U.S.)

- 3M Company (U.S.)

- Coveris (U.K.)

- Intertape Polymer Group (Canada)

- Saint-Gobain (France)

- Polyplast Europe (Germany)

The competitive strategy is overwhelmingly focused on R&D to enhance product quality and reduce costs, alongside forming strategic vertical partnerships with end-user companies to co-develop and validate new applications, thereby securing future demand.

Regional Analysis: A Global Footprint with Distinct Leaders

- North America: Is the undisputed leader, holding a 35% share of the global market. This dominance is fueled by massive infrastructure investments, a robust construction ecosystem, and strong demand from its advanced automotive and packaging sectors. The U.S. is the primary engine of growth in the region.

- Europe & China: Together, they form a powerful secondary bloc, accounting for 50% of the market. Europe's strength is driven by stringent energy directives and innovation in sustainable materials. China, supported by significant government backing and a massive manufacturing base, is a dominant producer and a rapidly growing consumer, particularly in construction and export packaging.

- Asia-Pacific (ex-China), South America, and MEA: These regions represent the emerging frontier of the Vapour Barrier Films market. While currently smaller in scale, they present significant long-term growth opportunities driven by increasing urbanization, investments in housing and waterproofing, and a growing focus on industrial protection.

Get Full Report Here: https://www.24chemicalresearch.com/reports/233910/global-vapour-barrier-films-forecast-market-2023-2032-601

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/233910/global-vapour-barrier-films-forecast-market-2023-2032-601

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

- Plant-level capacity tracking

- Real-time price monitoring

- Techno-economic feasibility studies

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

Other Related reports

Vinblastinesulphate Market Global Outlook and Forecast 2025-2032

Polypropylene (PP) Compounds Market, Global Outlook and Forecast 2025-2032

United States Metallurgical Silicon (MG-Si) Market Research Report 2025-2032

Zanamivir Market, Global Outlook and Forecast 2025-2032

2025-2032 Global and Regional Paint Stripping Industry Status and Prospects Professional Market Research

Global Aircraft Jet fuel Market Research Report 2025-2032(Status and Outlook)

Plastic Pallet Market, Global Outlook and Forecast 2025-2032

Biogas and Biomethane Market Size, Share Global Outlook and Forecast 2025-2032

Military Ammonium Perchlorate Market, Global Outlook and Forecast 2025-2032

Global Cyclohexane Market Research Report 2025-2032(Status and Outlook)

- Art

- Education et Formation

- Crafts

- Sciences et Technologies

- Economie

- Politique

- Actualité

- Littérature

- Divertissement

- Histoire

- Health

- Actualité

- Shopping & Commerce

- Music

- Agriculture & élevage

- Voyage et Evènementiel

- Beauté & esthétique

- Religion

- Festival

- Sports

- Fête

- Musique

- Autres