Europe Health Insurance Market – Digital Policy Management, Cost Containment Strategies & Regulatory Evolution

Executive Summary

The Europe Health Insurance Market is undergoing significant structural shifts as public healthcare systems face mounting pressure from aging demographics and rising medical costs. With the integration of Artificial Intelligence (AI) for personalized underwriting and a heightened focus on mental health coverage, the market is evolving into a more digital and patient-centric ecosystem. As of 2026, insurers are increasingly adopting "proactive prevention" models, moving beyond reactive claims processing to integrated wellness partnerships.

https://www.databridgemarketresearch.com/reports/europe-health-insurance-market

Market Overview

Health insurance in Europe is characterized by a diverse mix of statutory (public) and voluntary (private) systems. While nations like Germany and France possess high rates of public insurance coverage, there is a growing trend toward voluntary health insurance (VHI) to cover gaps in public provisions, such as specialized dental care, private hospital rooms, and reduced waiting times. The market is also being reshaped by the "European Health Data Space" initiative, which aims to improve data interoperability, thereby allowing insurers to offer more accurate, data-driven policy products.

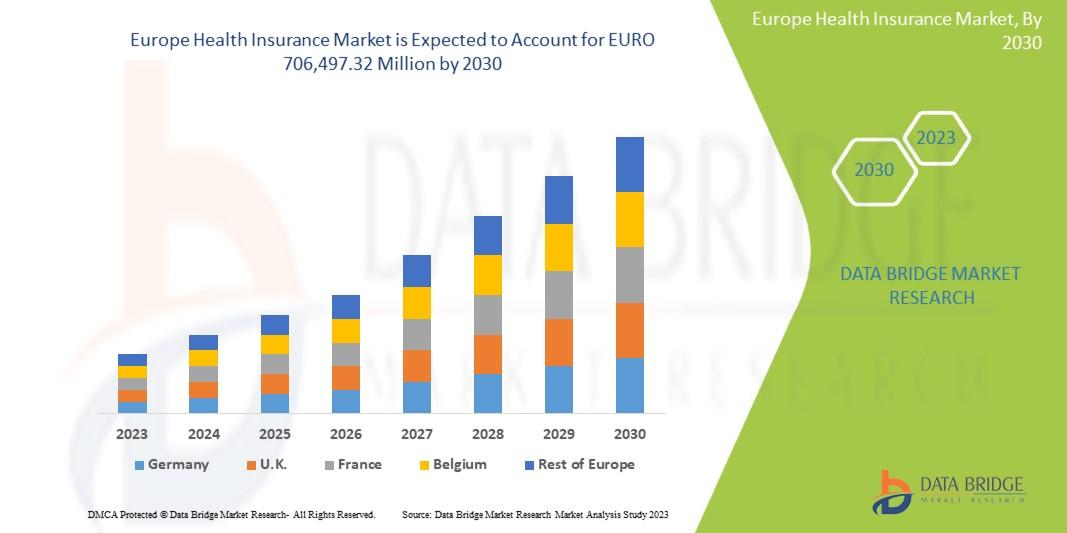

Market Size & Forecast

The Europe Health Insurance Market was valued at approximately USD 497.39 billion in 2024. The market is projected to grow at a CAGR of 7.01% during the forecast period from 2025 to 2032. By the end of 2032, the market is expected to reach a valuation of USD 702.34 billion. This growth is primarily fueled by the geriatric population expansion and a notable increase in voluntary insurance spending in key regions like the United Kingdom and Germany.

Market Segmentation

The European market is segmented across several categories to meet specific regional regulatory and consumer needs:

- By Provider Type:

- Public Providers: Remain the largest segment (approx. 57% share) due to strong government mandates in Central and Western Europe.

- Private Providers: The fastest-growing segment, driven by the demand for supplementary "top-up" plans.

- By Network:

- Point of Service (POS)

- Exclusive Provider Organization (EPO)

- Preferred Provider Organization (PPO)

- Health Maintenance Organization (HMO)

- By Demographics:

- Adults: The largest revenue-generating group, focusing on chronic disease management.

- Senior Citizens: Increasing demand for long-term care and geriatric-specific coverage.

- Minors: Growth in specialized pediatric and orthodontic coverage.

- By End User:

- Individual: Rising among freelancers and self-employed professionals.

- Group/Corporate: Represents the largest and fastest-growing sub-segment as employers use health benefits for talent retention.

Regional Insights

Germany currently leads the European market in terms of revenue, with a highly sophisticated dual system of statutory and private insurance. The United Kingdom is witnessing a surge in private medical insurance (PMI) as patients seek to bypass NHS waiting lists. France remains a key player due to its comprehensive "Mutuelle" system. The Nordic region is identified as a fast-growing pocket due to rapid digital adoption, while Italy and Spain are seeing increased private participation in the face of public funding constraints.

Competitive Landscape

The European landscape is dominated by multinational giants with deep capital reserves, though local niche players continue to thrive in specific country-level markets.

Top Market Players:

- AXA (France)

- Allianz SE (Germany)

- Assicurazioni Generali S.p.A. (Italy)

- Zurich Insurance Group (Switzerland)

- Aviva PLC (United Kingdom)

- Munich Re (Germany)

- Bupa (United Kingdom)

- CNP Assurances (France)

- Cigna (U.S./Europe Operations)

- MAPFRE (Spain)

https://www.databridgemarketresearch.com/reports/europe-health-insurance-market/companies

Trends & Opportunities

- Tele-Health Integration: Virtual consultations have become a standard inclusion in most premium European private plans to reduce outpatient costs.

- Mental Health Prioritization: Rapid expansion of "Mind Health" tools and confidential self-check services to address the rising incidence of workplace stress.

- Usage-Based Insurance (UBI): Rise of programs where premiums are linked to fitness tracking and healthy lifestyle choices through wearable data.

- Embedded Insurance: Growth of health coverage offered directly through employee-wellbeing platforms and non-traditional digital channels.

Challenges & Barriers

- Escalating Premium Costs: Annual premium increases of 3-5% in certain markets may hinder adoption among middle-income groups.

- Regulatory Compliance: Strict GDPR and Solvency II requirements increase the operational and capital burden on smaller insurers.

- Data Privacy Concerns: Public hesitation regarding the sharing of biometric and genomic data with private insurers.

- Healthcare Labor Shortages: A shortage of medical professionals across Europe can lead to longer service delivery times, impacting the perceived value of private insurance.

Conclusion

In conclusion, the Europe Health Insurance Market is positioned for steady growth as it adapts to the dual challenges of an aging population and fiscal strain on public budgets. By leveraging digital transformation and focusing on preventive care, insurers are successfully transitioning from traditional payers to holistic health partners. Despite regulatory complexities, the market remains a resilient and essential component of the European social and economic fabric.

https://www.databridgemarketresearch.com/reports/europe-health-insurance-market

Browse Trending Report: Europe Health Insurance Market

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email: corporatesales@databridgemarketresearch.com

- Art

- Education et Formation

- Crafts

- Sciences et Technologies

- Economie

- Politique

- Actualité

- Littérature

- Divertissement

- Histoire

- Health

- Actualité

- Shopping & Commerce

- Music

- Agriculture & élevage

- Voyage et Evènementiel

- Beauté & esthétique

- Religion

- Festival

- Sports

- Fête

- Musique

- Autres