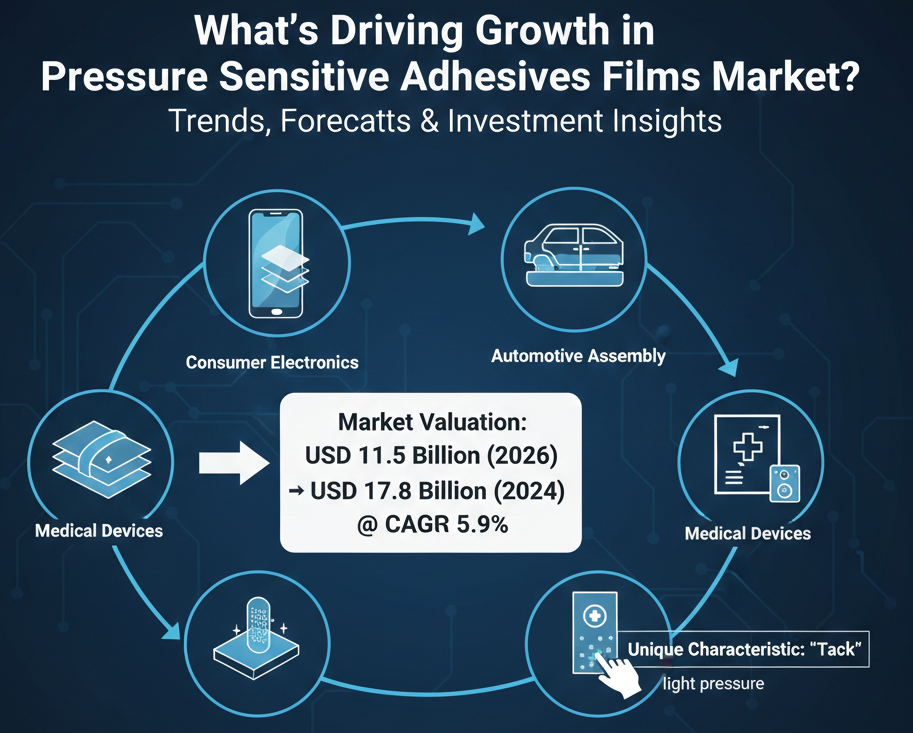

What’s Driving Growth in Pressure Sensitive Adhesives Films market? Trends, Forecasts & Investment Insights

According to 24 Chemical Research, Global Pressure Sensitive Adhesives Films market was valued at USD 11.5 billion in 2026 and is projected to reach USD 17.8 billion by 2034, exhibiting a steady CAGR of 5.9% during the forecast period.

Pressure Sensitive Adhesive (PSA) Films are among the most versatile and widely adopted bonding solutions in modern manufacturing. Unlike traditional adhesives that require heat, water, or a chemical activator to form a bond, PSA films adhere to surfaces upon the application of light pressure. This unique characteristic, known as "tack," makes them indispensable across a vast range of industries, from consumer electronics and automotive assembly to medical device manufacturing and graphic arts. These films consist of an adhesive layer coated onto a carrier material—such as paper, PET, or PVC—creating a clean, uniform, and easy-to-apply product that has revolutionized assembly and finishing processes worldwide.

Get Full Report Here: https://www.24chemicalresearch.com/reports/261082/global-pressure-sensitive-adhesives-films-forecast-market-2024-2030-27

Market Dynamics:

The market's growth is propelled by a complex interplay of powerful drivers, significant restraints that necessitate innovation, and a landscape rich with emerging opportunities.

Powerful Market Drivers Propelling Expansion

-

Exponential Growth in Flexible Electronics and Displays: The relentless trend toward device miniaturization and the proliferation of flexible displays in smartphones, wearables, and foldable tablets represent a primary growth vector. PSA films are critical for bonding delicate, ultrathin components without applying thermal or solvent stress. The global flexible electronics market, projected to exceed $50 billion by 2027, relies on high-performance acrylic and silicone PSA films for laminating touch sensors, shielding layers, and OLED panels, where traditional liquid adhesives would be impractical or damaging.

-

Automotive Lightweighting and Electrification: The automotive industry's dual mandates of lightweighting for fuel efficiency and the rapid shift to electric vehicles (EVs) are driving substantial demand. PSA films are used to bond interior trim, nameplates, and lightweight composite panels, replacing mechanical fasteners and reducing vehicle weight by several kilograms. In EV battery packs, specialized PSA films provide critical thermal interface management and component fixation, ensuring safety and longevity. With over 30 million EVs expected to be sold annually by 2030, this application segment is experiencing explosive growth.

-

Medical Device Innovation and Hygiene Trends: The healthcare sector's demand for single-use, skin-friendly, and biocompatible adhesives is a major driver. PSA films are essential in transdermal drug patches, wearable medical monitors, and wound care products. The COVID-19 pandemic accelerated the adoption of PSA films for medical tapes and diagnostic device assembly. With an aging global population and a growing focus on remote patient monitoring, the medical segment is poised for sustained, high-value growth, demanding adhesives that meet stringent ISO 10993 biocompatibility standards.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/261082/global-pressure-sensitive-adhesives-films-forecast-market-2024-2030-27

Significant Market Restraints Challenging Adoption

Despite their advantages, the widespread adoption of PSA films faces notable hurdles that the industry is actively working to overcome.

-

Cost Sensitivity in Mature Applications: In highly price-competitive sectors like general industrial assembly and basic packaging, the initial cost of high-performance PSA films can be a deterrent. While they offer savings in application speed and labor, the raw material cost for specialty acrylics and silicones can be 20-35% higher than that of traditional liquid adhesives or mechanical fasteners. This creates a significant barrier for small and medium-sized enterprises (SMEs) and in applications where the superior performance is not deemed critical.

-

Performance Limitations Under Extreme Conditions: Standard acrylic and rubber-based PSA films can experience "creep" or debonding when subjected to sustained load, high temperatures, or prolonged UV exposure. In automotive under-the-hood applications or outdoor construction, where temperatures can exceed 150°C, standard products fail. This performance gap necessitates the development of more advanced, and often more expensive, silicone or hybrid chemistries, limiting their use in the most demanding environments without significant R&D investment.

Critical Market Challenges Requiring Innovation

The journey from formulation to final application presents a set of complex technical and logistical challenges.

One of the foremost challenges is achieving consistent adhesion performance across diverse substrates. Modern manufacturing involves bonding plastics, metals, composites, and coated surfaces, each with different surface energies. A PSA film that performs excellently on high-surface-energy aluminum may fail on low-surface-energy polypropylene. This requires sophisticated surface treatment technologies like corona, plasma, or chemical priming, adding steps and cost to the manufacturing process.

Furthermore, the industry faces increasing pressure to develop sustainable solutions. While PSA films reduce waste compared to solvent-based adhesives, the carrier films (often PET or PVC) and silicone release liners contribute to plastic waste. Developing bio-based adhesives, compostable carriers, and linerless tape technologies is a major R&D focus, but these innovations currently come with a significant cost premium and sometimes a trade-off in performance, creating a complex challenge for manufacturers aiming to balance sustainability with practicality.

Vast Market Opportunities on the Horizon

-

Advanced Sustainable and Bio-Based Formulations: The push for circular economy principles is creating a massive opportunity for "green" PSA films. Innovations in bio-acrylics derived from plant-based feedstocks and the development of recyclable mono-material constructions are gaining traction. Major brands are increasingly mandating sustainable packaging and assembly materials, opening a new, high-growth segment for manufacturers who can deliver performance without the environmental footprint.

-

Smart and Functional Adhesives: The frontier of PSA technology lies in adding functionality beyond simple bonding. Conductive PSA films for electromagnetic interference (EMI) shielding are critical in 5G devices. Thermally conductive but electrically insulating films are essential for managing heat in high-power electronics. The emergence of "debondable-on-demand" films, which lose adhesion when exposed to a specific stimulus like heat or UV light, is revolutionizing product repairability and recycling, particularly in electronics.

-

Expansion in Emerging Economies: As manufacturing continues to grow in regions like Southeast Asia, India, and Latin America, the demand for efficient assembly materials follows. The construction boom, rising disposable incomes driving consumer electronics sales, and the establishment of new automotive production facilities in these regions present a long-term growth opportunity for PSA film suppliers willing to establish local production and distribution networks.

In-Depth Segment Analysis: Where is the Growth Concentrated?

By Type:

The market is segmented into Acrylic, Rubber, Silicone, EVA, and others. Acrylic-based PSA films dominate the market, prized for their excellent UV resistance, clarity, and aging performance, making them ideal for outdoor applications, graphics, and electronics. Silicone-based films, while more expensive, hold a critical position in high-temperature and medical applications due to their superior thermal stability and biocompatibility.

By Application:

Application segments include Building Materials, Home Appliance, Electronic, Advertising Materials, and others. The Electronic segment is the largest and fastest-growing, driven by the insatiable demand for smartphones, tablets, and IoT devices. PSA films are used for display assembly, component fixation, and EMI shielding. The Building Materials segment is also significant, utilizing films for bonding panels, flooring underlayments, and window films.

By End-User Industry:

The end-user landscape includes Electronics, Automotive, Aerospace, Healthcare, and Energy. The Electronics industry accounts for the lion's share of consumption. However, the Automotive and Healthcare sectors are emerging as key growth drivers, reflecting trends in vehicle electrification, lightweighting, and advanced medical technologies.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/261082/global-pressure-sensitive-adhesives-films-forecast-market-2024-2030-27

Competitive Landscape:

The global Pressure Sensitive Adhesives Films market is highly competitive and fragmented, characterized by the presence of global chemical giants and specialized manufacturers. The top three companies—3M (U.S.), Henkel (Germany & US), and LINTEC Corporation (Japan)—collectively command a significant portion of the market share. Their leadership is underpinned by vast R&D capabilities, extensive product portfolios spanning multiple chemistries, and strong, established relationships with global OEMs across key industries.

List of Key Pressure Sensitive Adhesives Films Companies Profiled:

-

3M (U.S.)

-

Henkel (Germany & US)

-

Hitachi Chemical (Japan)

-

DowDuPont (U.S.)

-

Mactac (U.S.)

-

Toyochem (Japan)

-

LINTEC Corporation (Japan)

-

PANACLEAN (South Korea)

-

Soken (Japan)

-

VIBAC (Italy)

-

Acucote (U.S.)

-

No-Tape Industrial (Taiwan)

-

ADHETEC (South Korea)

-

Bostik (France)

-

HMT Manufacturing (U.S.)

-

Weifang Shengda Technology (China)

-

LASPEF (France)

The competitive strategy is centered on continuous product innovation to meet evolving application demands, strategic mergers and acquisitions to expand geographic and technological reach, and a strong focus on developing sustainable adhesive solutions to align with global environmental trends.

Regional Analysis: A Global Footprint with Distinct Leaders

-

Asia-Pacific: Is the dominant force in the global PSA films market, accounting for over 50% of global consumption. This leadership is driven by the region's massive electronics manufacturing base, particularly in China, South Korea, and Japan, coupled with robust growth in automotive production and construction activities. The region is both the largest producer and consumer of PSA films.

-

North America and Europe: Together, these mature markets represent a significant share of the global market. Their growth is fueled by technological advancements, high-value applications in aerospace and medical devices, and strong demand from the automotive industry for lightweighting solutions. The presence of major end-user industries and stringent regulatory standards drives the adoption of high-performance, specialty PSA films in these regions.

-

South America, and Middle East & Africa: These regions are currently smaller markets but present promising growth potential. Increasing industrialization, infrastructure development, and the gradual expansion of manufacturing capabilities are expected to drive future demand for PSA films, particularly in construction and consumer goods assembly.

Get Full Report Here: https://www.24chemicalresearch.com/reports/261082/global-pressure-sensitive-adhesives-films-forecast-market-2024-2030-27

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/261082/global-pressure-sensitive-adhesives-films-forecast-market-2024-2030-27

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

-

Plant-level capacity tracking

-

Real-time price monitoring

-

Techno-economic feasibility studies

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

- Art

- Education et Formation

- Crafts

- Sciences et Technologies

- Economie

- Politique

- Actualité

- Littérature

- Divertissement

- Histoire

- Health

- Actualité

- Shopping & Commerce

- Music

- Agriculture & élevage

- Voyage et Evènementiel

- Beauté & esthétique

- Religion

- Festival

- Sports

- Fête

- Musique

- Autres