Nylon Airbag Yarns market Growth Explained: Key Drivers, Opportunities & Future Outlook

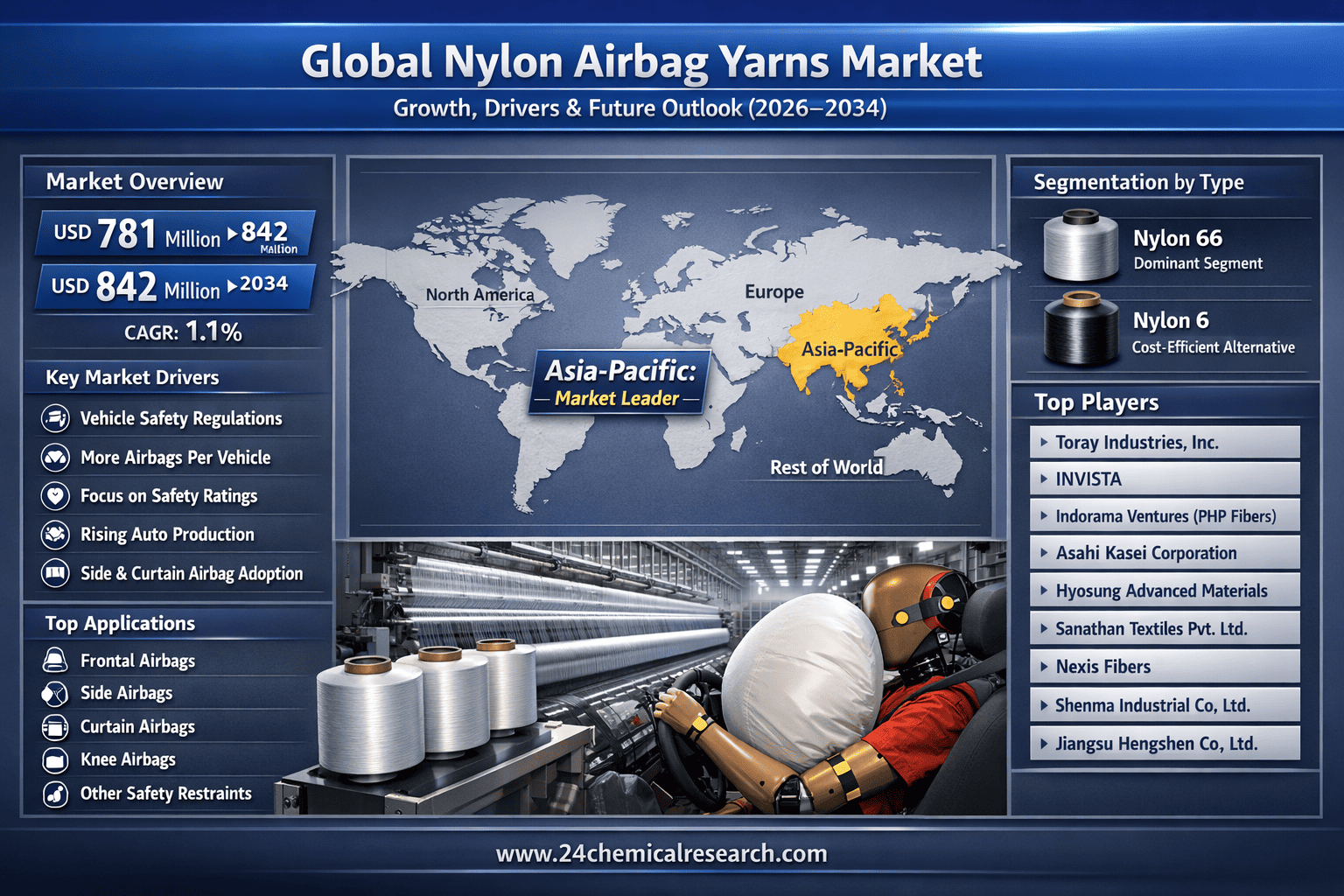

According to 24Chemical Research, Global Nylon Airbag Yarns market was valued at USD 781 million in 2026 and is projected to reach USD 842 million by 2034, exhibiting a steady CAGR of 1.1% during the forecast period.

Nylon airbag yarns represent a highly specialized class of industrial fibers, primarily composed of Nylon 6 and Nylon 66 polymers, engineered to meet the exacting demands of automotive safety restraint systems. These yarns are distinguished by their exceptional tensile strength, superior heat resistance, and remarkable dimensional stability under extreme conditions. When woven into fabric, they form the critical barrier that rapidly inflates during a collision to cushion vehicle occupants, a function where material failure is not an option. The inherent properties of nylon—particularly its ability to absorb and dissipate immense kinetic energy while resisting thermal degradation—have solidified its position as the material of choice for the most safety-critical airbag applications. These performance characteristics are non-negotiable, as they directly correlate with the system's ability to deploy predictably within milliseconds and provide reliable protection, making nylon yarns a cornerstone of modern vehicle passive safety systems.

Get Full Report Here: https://www.24chemicalresearch.com/reports/299766/nylon-airbag-yarns--market-market

Market Dynamics:

The market's trajectory is shaped by a complex interplay of powerful growth drivers, significant restraints that are being actively addressed, and vast, untapped opportunities.

Powerful Market Drivers Propelling Expansion

-

Stringent Global Safety Regulations and Rising Airbag Fitment Rates: The single most powerful driver is the global implementation and tightening of vehicle safety standards. Regulatory bodies like the NHTSA in the U.S., Euro NCAP in Europe, and similar agencies in Asia mandate increasingly comprehensive occupant protection. This is no longer limited to basic frontal airbags; regulations now often require side-impact, side-curtain, knee, and even rear-seat airbags. Consequently, the average number of airbags per vehicle continues to climb, directly fueling demand for high-performance nylon yarns. This regulatory push creates a non-discretionary, steadily growing baseline demand from automotive OEMs worldwide, who must comply to sell their vehicles in major markets.

-

Consumer Safety Awareness and Demand for Advanced Protection: Beyond regulation, consumer perception of safety has become a primary purchasing factor. Vehicle safety ratings from organizations like the IIHS and Euro NCAP are highly publicized and significantly influence buying decisions. Car manufacturers, in a bid to achieve top ratings and meet consumer expectations, are proactively incorporating more advanced and numerous airbag systems into their vehicles, even before they are legally required. This market-driven demand for superior safety features ensures a continuous pull for high-quality nylon yarns, as manufacturers seek to differentiate their brands through best-in-class occupant protection.

-

Growth of the Global Automotive Fleet and Production Recovery: Underpinning the specific demand for airbag yarns is the overall health and growth of the global automotive industry. As vehicle production volumes recover and expand, particularly in emerging economies, the absolute number of airbag systems required increases proportionally. Furthermore, the trend towards larger vehicles—SUVs and trucks—which often necessitate more robust and sometimes larger airbag systems, further contributes to yarn consumption. The expansion of automotive manufacturing hubs in Asia and other regions ensures a broadening base of demand for these critical components.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/299766/nylon-airbag-yarns--market-market

Significant Market Restraints Challenging Adoption

Despite its promise, the market faces hurdles that must be overcome to achieve universal adoption.

-

Material Competition and Cost Pressure from Polyester: While nylon dominates high-stress applications, it faces intense competition from polyester yarns, particularly in areas like curtain airbags where the thermal and mechanical demands are slightly less extreme. Polyester offers a compelling cost advantage and sufficient performance for certain designs, leading to its adoption in cost-sensitive vehicle segments and specific airbag types. This competitive pressure forces nylon producers to continuously innovate to justify their premium and defend their market share in key applications, while also driving efforts to reduce production costs.

-

Complexity and High Cost of Manufacturing and Qualification: Producing airbag-grade nylon yarn is a capital-intensive process requiring advanced polymerization, precise spinning technology, and rigorous quality control. The yarn must meet incredibly tight specifications for strength, elasticity, and consistency. Furthermore, the qualification process for becoming an approved supplier to an airbag fabric maker or automotive OEM is lengthy and expensive, often taking years and involving exhaustive testing. This high barrier to entry limits the number of new players and concentrates production among a few established, technologically adept companies.

Critical Market Challenges Requiring Innovation

The transition from laboratory success to industrial-scale manufacturing presents its own set of challenges. Maintaining absolute material consistency across multi-ton production batches is paramount, as any deviation can affect the airbag's deployment characteristics. The entire supply chain, from raw polymer to finished airbag module, is highly interdependent, making it vulnerable to disruptions in feedstock availability or price volatility for key inputs like caprolactam and adipic acid. Furthermore, the industry must continually adapt to new vehicle architectures, particularly with the rise of electric and autonomous vehicles, which may necessitate全新的 airbag designs and thus new yarn specifications. This requires ongoing, close collaboration between yarn producers, fabric weavers, and OEMs to anticipate and meet future needs.

Additionally, the rapid evolution of airbag technology itself presents a challenge. The industry is moving towards more complex systems like One-Piece-Woven (OPW) airbags and adaptive systems that adjust deployment based on occupant size and crash severity. These advancements demand yarns with even more specialized properties, pushing manufacturers to invest heavily in R&D to keep pace with the engineering requirements of next-generation safety systems.

Vast Market Opportunities on the Horizon

-

Expansion in Emerging Economies and New Regulatory Frontiers: Significant growth potential lies in emerging markets across Asia, Latin America, and Africa. As these regions develop economically, they are progressively adopting stricter vehicle safety standards, moving from having few or no airbag mandates to requiring comprehensive systems. This represents a massive, largely untapped market for nylon airbag yarns as local vehicle production incorporates these new safety features. The gradual alignment of global safety standards opens up long-term, sustained growth opportunities for yarn suppliers in these developing regions.

-

Innovation in Product Performance and Sustainable Solutions: There is a growing opportunity to develop next-generation nylon yarns with enhanced properties—such as lighter weight for improved vehicle efficiency, better aging resistance for longer product lifecycles, and tailored elongation profiles for optimized deployment. Furthermore, the automotive industry's increasing focus on sustainability creates an opportunity for innovations like yarns made from recycled content. Developing a certified, high-performance recycled nylon yarn that meets all safety standards could become a significant differentiator and capture value in an increasingly eco-conscious market.

-

Integration with New Vehicle Technologies and Strategic Partnerships: The rise of electric and autonomous vehicles is not just a challenge but a major opportunity. These new platforms often feature unique interior designs and safety concepts that may require novel airbag solutions, opening avenues for specialized yarn applications. Successfully navigating this transition will likely depend on forming deep strategic partnerships directly with EV manufacturers and Tier-1 suppliers to co-develop and validate new products specifically for these next-generation vehicles, securing a position in a high-growth segment of the automotive market.

In-Depth Segment Analysis: Where is the Growth Concentrated?

By Type:

The market is segmented primarily into Nylon 6 and Nylon 66 yarns. Nylon 66 maintains its dominance, particularly for frontal airbag applications, due to its superior mechanical strength, higher melting point, and excellent thermal stability, which are critical for managing the extreme forces and temperatures of a rapid inflation event. Its long-standing validation and proven reliability in the most demanding scenarios make it the preferred choice where performance is paramount. Nylon 6 is also widely used, often finding application in other airbag types where the specific performance demands of Nylon 66 are not as critical, offering a balance of performance and cost-effectiveness.

By Application:

Application segmentation is closely tied to airbag types: Frontal Airbags, Side Airbags, Curtain Airbags, Knee Airbags, and Others. The Frontal Airbags segment remains the largest and most demanding application, consuming the highest grade of nylon yarn due to the critical nature of its function. However, the fastest growth is observed in Curtain and Knee Airbag segments, as these become standard equipment in more vehicle models globally. The expansion of side-impact protection systems is a key trend, driving increased material consumption per vehicle and shifting the application mix over time.

By End-User Industry:

The end-user landscape is defined by the automotive supply chain: Airbag Fabric Weavers, Airbag Module Assemblers (Tier 1), and Automotive OEMs. The Airbag Fabric Weavers are the primary direct customers for the yarn. These specialized manufacturers operate under stringent quality mandates from OEMs and Tier 1 suppliers, making them highly focused on yarn consistency, performance, and reliability. They convert the yarn into coated fabric, which is then supplied to module manufacturers who assemble the complete airbag system before delivery to the vehicle assembly plant.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/299766/nylon-airbag-yarns--market-market

Competitive Landscape:

The global Nylon Airbag Yarns market is a consolidated and mature landscape, characterized by high barriers to entry and dominated by a handful of large, multinational chemical and fiber producers. The market leaders possess deep technological expertise in polymer science and high-tenacity yarn production, along with long-standing, certified relationships with Tier-1 suppliers and automotive OEMs. Competition is intense and primarily based on product quality, consistency, technological innovation, and the ability to provide global supply security. These established players continuously invest in R&D to enhance yarn properties and production efficiency, while also focusing on strategic vertical integration and partnerships to secure their positions in this critical automotive supply chain.

List of Key Nylon Airbag Yarns Companies Profiled:

-

Toray Industries, Inc. (Japan)

-

INVISTA (U.S.)

-

Indorama Ventures (PHP Fibers GmbH) (Thailand/Germany)

-

Asahi Kasei Corporation (Japan)

-

Hyosung Advanced Materials (South Korea)

-

Sanathan Textiles Pvt. Ltd. (India)

-

PHP Fibers GmbH (A part of Indorama Ventures) (Germany)

-

Nexis Fibers (Switzerland)

-

Shenma Industrial Co., Ltd. (China)

-

Jiangsu Hengshen Co., Ltd. (China)

The competitive strategy is overwhelmingly focused on maintaining impeccable quality standards, achieving production excellence to manage costs, and fostering deep, collaborative relationships with downstream partners to develop solutions for the next generation of vehicle safety systems.

Regional Analysis: A Global Footprint with Distinct Leaders

-

Asia-Pacific: Is the undisputed dominant force in the global market, accounting for the largest share of both production and consumption. This leadership is fueled by the region's status as the world's largest automotive manufacturing hub, with major production centers in China, Japan, South Korea, and increasingly in Southeast Asia. The presence of key yarn producers and a dense ecosystem of fabric weavers and module suppliers creates a powerful, integrated supply chain. Rising safety standards and vehicle ownership in developing Asian economies further solidify the region's leading position for future growth.

-

Europe and North America: Together represent mature but critical markets characterized by the highest safety standards and a concentration of premium vehicle manufacturers. These regions are hubs for innovation in airbag technology and are often the first to adopt new safety features. Demand is stable and driven by regulatory compliance, replacement demand, and the continuous technological upgrading of safety systems. The presence of leading automotive OEMs and Tier-1 suppliers ensures a steady demand for high-performance nylon yarns, particularly for luxury and high-specification vehicles.

-

Rest of the World (South America, MEA): These regions represent the emerging growth frontier for the nylon airbag yarn market. While currently smaller in volume, they present significant long-term potential as local vehicle production expands and safety regulations gradually align with global standards. Economic development, increasing industrialization, and growing consumer awareness of vehicle safety are expected to drive increased adoption of airbag systems, creating new opportunities for yarn suppliers in these markets over the coming decade.

Get Full极速赛车开奖结果历史记录 Here: https://www.24chemicalresearch.com/reports/299766极速赛车开奖结果历史记录/nylon-airbag-yarns--market-market

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/299766/nylon-airbag-yarns--market-market

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key极速赛车开奖结果历史记录 industry factors such as government policy, emerging technologies, and competitive landscapes.

-

Plant-level capacity tracking

-

Real-time price monitoring极速赛车开奖结果历史记录

-

Techno-economic feasibility studies

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

- Art

- Education et Formation

- Crafts

- Sciences et Technologies

- Economie

- Politique

- Actualité

- Littérature

- Divertissement

- Histoire

- Health

- Actualité

- Shopping & Commerce

- Music

- Agriculture & élevage

- Voyage et Evènementiel

- Beauté & esthétique

- Religion

- Festival

- Sports

- Fête

- Musique

- Autres